TFSAs: More than just a savings account

Despite the name, a Tax-Free Savings Account (TFSA) does not have to be a cash savings account. Like an RRSP, a TFSA may contain cash and/or other investments such as mutual funds, certain stocks, bonds or guaranteed investment certificates (GICs).

The TFSA is definitely one of the most interesting and valuable investment accounts available

Let’s compare a TFSA with a non-registered savings account. Contributions to both are made with after-tax dollars, and both accounts offer similar scope for diverse investments. But the non-registered account’s returns will be taxed while the TFSA’s returns won’t. So the TFSA will produce more spending money for you, especially after years of compound growth.

A tip: are you now holding GICs in a taxable account? If so, within your normal contribution limit you can convert them to a TFSA and never pay tax on that money again.

Now let’s compare a TFSA to a non-registered investment account. Say you sell a money-making mutual fund from a non-registered investment account. Half the capital gain will be added to your income for the year and taxed accordingly. But there’s no tax on such a sale inside a TFSA – and no tax due when that money is withdrawn from the account. So, again, the TFSA will produce more spending money for you, especially after years of compound growth.

The federal government grants TFSA contribution room to every Canadian starting at age 18 – even if the age of majority in their province is 19 and they’re not yet allowed to open an account. Significantly, unused contribution room gets carried forward and money withdrawn from a TFSA can be returned to the account the following year without counting against the new contribution limit.

| Years | TFSA Annual Limit | Cumulative Total |

| 2009-2012 | $5,000 | $20,000 |

| 2013-2014 | $5,500 | $31,000 |

| 2015 | $10,000 | $41,000 |

| 2016-2018 | $5,500 | $57,500 |

| 2019-2022 | $6,000 | $81,500 |

| 2023 | $6,500 | $88,000 |

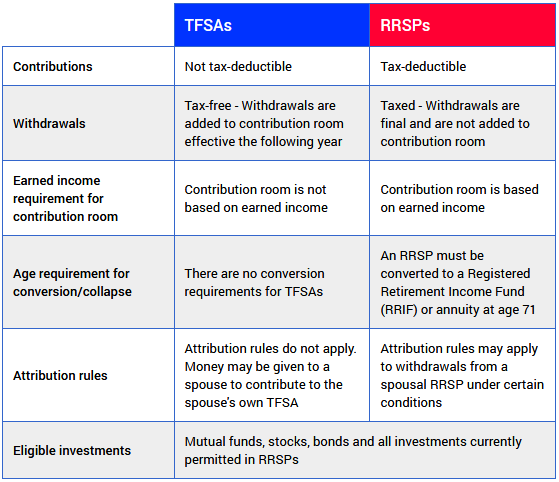

TFSAs compared to RRSPs

Many people wonder if it’s better to contribute to a TFSA or an RRSP. Unused contribution room gets carried forward in both cases. Here are two rules of thumb:

- If you’re young – say under 40 – favour the TFSA. You likely need money for household formation. Also, your prime earning years are still likely ahead of you and the higher your income, the greater the tax-saving value you can get from a RRSP contribution. You might build your TFSA now and, when your earnings peak, use money from the TFSA for a catch-up RRSP contribution.

- Favour the RRSP if your tax rate in retirement is expected to be lower than your tax rate now. Favour the TFSA if it’s the other way around.

In British Columbia, Newfoundland and Labrador, Nova Scotia and New Brunswick the age of majority is 19 and a TFSA may not be opened until then. However, you will accumulate contribution room from the time you are 18. With files from CRA and Fidelity Investments. As with most investments, federal and provincial laws impact estate planning.